With a worksheet, you can easily spot discrepancies and identify areas where you need to get on track. It tallies your planned expenses, savings and income as actual numbers for each category. When you add up each section of the worksheet, you can understand whether your anticipated income is enough to pay for your planned expenses and savings. That means you can quickly assess whether your budget is balanced or if you need to reduce expenses or increase income.

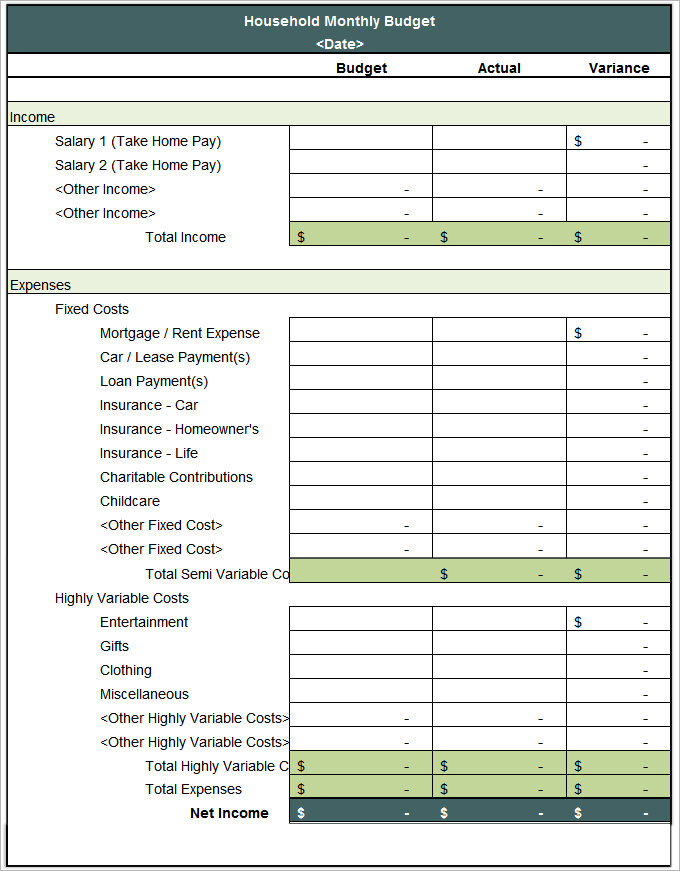

It tracks income and expenses in one convenient place. Using a worksheet to track your finances offers several benefits: Why is a budget worksheet important?Ī budget worksheet is a simple spreadsheet or chart where you can record your income, expenses and savings. When you create your budget sheet in a spreadsheet, you can add or remove rows and columns to reflect your unique financial situation. You can create budget sheets using basic spreadsheet software, or you can track your income, savings and expenses by hand in a notebook or accounting journal. What is a budget worksheet?Ī budget worksheet is an effective tool for listing, tracking and evaluating all your income sources, expenses and savings. In this article, we discuss why a budget worksheet is important and what to include in one, with a template and example for more insight. You can also see where you might be overspending so you can improve your budget and find ways to save more each month. An effective budget can also help you monitor your spending and identify any patterns in your financial activities. In this article, we discuss what to include in a budget worksheet and we provide a template and an example to help you get started.Ī budget worksheet can be highly effective for tracking your income and expenses, along with any savings you deposit.

An effective budget worksheet can help you keep track of expenses, identify spending patterns that could help you avoid over-spending and also boost your ability to save money each month.

0 kommentar(er)

0 kommentar(er)